As you know, there are many reasons for foreigners to buy real estate in Turkey, and many privileges were an incentive for them.

Among the group of positives that encourage investors and those interested in the real estate sectors to choose Turkey over other countries in the world to own real estate and invest in its real estate.

Important information about tax exemption in Turkey will be presented to you by the editorial team at Hana Real Estate through this report that it prepared for you.

How to get tax exemption in Turkey?

In order to be one of the beneficiaries of the tax exemption, you must apply to the relevant authorities in Turkey in order to obtain an exemption certificate, but what should be noted here is that you must be careful while submitting papers and the file, as the presence of any defect, error or deficiency prevents you from obtaining the exemption, so we advise you To be accompanied by a real estate expert and specialist in the field of real estate in Turkey.

When are you exempt from the value added tax in Turkey? According to the Turkish Constitution, there are many cases in which a foreigner is exempted from paying this tax, and they are as follows.

The first case: foreigners who do not reside in Turkey or companies that are not based in Turkey can easily obtain exemption.

Second case: the foreigner must not have resided in Turkey for more than six months in the last year.

The third case: The foreigner should not have a valid residence permit from the previous year.

Fourth case: the foreigner must not have an address in Turkey, and if he has one, he can simply cancel the address.

Fifth case: The property buyer is exempted from paying the value added tax if the property is new, while the matter does not apply to old properties.

The fifth case: the tax exemption can be obtained only when buying residential real estate such as villas and apartments. In the case of buying commercial real estate such as offices – shops and others, the exemption law does not cover it.

The sixth case: The price of the property must be paid in foreign currency by transferring it from outside Turkey through a bank and then proving this by submitting a document confirming this.

In the event that the amount is transferred to Turkey in cash, a customs declaration document must be submitted.

The seventh case: Whoever buys a property in Turkey and obtains a tax exemption will not be able to sell the property before one year has passed since the date of its purchase.

The eighth case: the property must be newly constructed and this is the first time it has been sold. If it has been sold more than once, everyone who previously owned it must be Turkish citizens.

Documents required for tax exemption:

Below are the most prominent documents that must be submitted to obtain exemption from VAT in Turkey.

– A copy of the buyer’s passport.

– A document confirming that the applicant for the exemption resides in a country other than Turkey.

– The tax number can be extracted from the tax department.

– A power of attorney document for a person residing in Turkey in case the buyer was unable to attend in person.

What can be mentioned in this regard is that exempting foreigners from paying tax saves the investor a lot of money and gives him more room to get profits.

Types of VAT in Turkey:

The value of the added tax ranges from 1% to 18% and varies according to the type of property, its area, specifications, value, and the region in which it is located. In general, we have three types of this tax, which are as follows.

1 – 1% for real estate with an area of less than one hundred and fifty square meters.

2 – 8% for real estate with an area of more than one hundred and fifty square meters.

3 – 18% for high-priced luxury properties, whether residential or commercial properties.

It is necessary to note that there are some types of real estate that are not covered by tax exemption besides commercial real estate such as land – farms.

Types of real estate taxes in Turkey:

After the increase in the presence of foreigners in Turkey wishing to buy and own real estate, there are many questions about everything related to this field, especially with regard to the issue of real estate taxes.

Through the following paragraphs, we will talk about everything related to real estate taxes in Turkey, but before that it should be noted that the laws that apply to foreigners are the same as those that apply to Turks.

First: Fees for obtaining a property title deed:

It is one of the mandatory fees that you must pay when buying real estate in Turkey. It has been set at 4% of the total property value and according to the tax law, it must be paid by both the buyer and seller equally, and in some cases it is agreed between the two parties that the buyer will pay it in full.

Second: Initial Contract Installation Fees:

As for this tax, it is not compulsory and can be chosen or not, but some people prefer to adhere to it, especially if the property is under construction or has purchased the property in installments, because then the ownership will not be transferred to him until after the completion of the construction stages or the full price of the property is paid.

A contract is written and signed between the seller and the buyer at the notary, through which the buyer guarantees his right and amounts to 1% of the total property value.

Third: Annual Real Estate Tax:

Among the taxes imposed on real estate ownership in Turkey is the (annual tax), which amounts to about 0.002 of the property price and is paid in two stages, the first in March of each year and the second in October.

This tax is paid either by going to the municipality building or when transferring it to the municipality’s bank account.

Fourth: Revenues of residential complexes:

When you choose to live in residential complexes in Turkey, there are a lot of wages and costs that you must pay per month, which average fifty dollars. These fees vary from one complex to another depending on the services that were provided.

This amount is for periodic cleaning services – continuous maintenance – recreational services.

Fifth: Real Estate Profit Tax:

This tax is paid if you want to sell the property before five years have passed since the date of its purchase. If it was sold before these years, the buyer will not be responsible or charged with paying it.

Sixth: Municipal taxes and fees:

About 0.03% of the total property value must be paid annually in the month of May to the municipality of the area in which you own the property.

Seventh: Translation and attestation fees:

The real estate buyer must pay all the costs of translating documents into Turkish, such as the Turkish passport, as well as the costs of the translator accompanying it, and there are also the costs of attesting the papers with the notary.

Eighth: Earthquake insurance tax:

When buying a property in Turkey, an earthquake insurance policy known as (dask) must be obtained, and this amount is paid annually to an insurance company.

This amount is paid after the property has been purchased and its ownership has been transferred to the buyer. The fees for extracting it vary according to the property, its location and specifications.

Ninth: The real estate appraisal document:

One of the basic conditions for buying real estate in Turkey is to extract a real estate appraisal report, which determines the value of the property accurately and prevents sellers from manipulating prices without controls.

It can be extracted with the help of one of the competent authorities that obtained a license from the Turkish government, and it will not take more than three days, and the cost of extracting it is about two hundred dollars as a maximum.

Other facilities offered by Turkey to foreigners when buying real estate in Turkey:

Tax reduction is one of the most important facilities provided by the Turkish government to foreigners wishing to own and buy real estate in Turkey, which combined with other privileges.

Through the following paragraphs, we will talk about the most important and prominent factors that encourage foreigners to buy real estate in Turkey.

1 – Amendment to the law on obtaining Turkish citizenship:

Due to the desire of many foreigners to obtain Turkish citizenship through real estate investment, it is working on issuing many modifications and updates that intersect with the interests of foreigners.

At the end of 2018, it issued a decision to reduce the value of the appropriate investment to obtain citizenship from one million US dollars to two hundred and fifty thousand dollars only in return for a commitment not to sell it before three years have passed since the date of its purchase.

This nationality is considered one of the best and most important nationalities in the world due to the many privileges it grants, the most important of which is obtaining a Turkish passport and benefiting from the rights of Turkish citizenship.

2 – The real estate appraisal document gives him safety and reassurance:

The real estate valuation report is considered one of the motivators that help foreigners and investors to make the decision to invest in Turkey and not other countries around the world because it protects him from being a victim of fraud and price manipulation.

Due to your lack of experience and your extensive knowledge of the real estate market in Turkey, you may pay thousands of Turkish liras, but this report adjusts prices and gives real estate its real value.

3 – Abolished the Reciprocity Law:

In September of 2012, the Turkish state issued a law providing for the abolition of the reciprocity law and through which it allowed all foreigners in the world to own property in Turkey without restrictions.

This decision encouraged many investors to search for real estate for sale in Turkey in light of the many restrictions and difficulties imposed by European countries.

4 – Possibility of obtaining real estate residency:

Real estate residency is one of the most important types of residency in Turkey, as it gives its holder a lot of privileges and is also easy to obtain.

– Those who carry it can easily move between Turkish states without restrictions.

– Traveling outside Turkey and returning without the condition of obtaining a travel permit.

– Benefit from medical services and educational privileges.

– There is no condition related to the price of the property as Turkish citizenship.

One of the most important conditions for obtaining it is that the property be residential, and although it is of short duration, it can be renewed annually.

5 – Real estate prices in Turkey:

Do you think that real estate prices in Turkey are high?According to many official and competent authorities, such as the American newspaper The Times, real estate prices in Turkey are about 50% to 60% cheaper than prices in countries in Eastern Europe, and 80% to 90% cheaper than prices in Western European countries.

6 – Continuously developing its infrastructure:

The Turkish government has spared no effort in developing and improving the infrastructure for its absolute belief in the importance of its reflection on the real estate sector.

Turkey has the most important strategic projects in the world, such as the new Istanbul Airport, which is one of the largest, most modern and advanced air transport stations in the world.

It is also in the process of building one of the most important mega projects (the new Istanbul Water Canal), which will have a significant impact on the Turkish economy and the real estate sector.

In the year 2020 AD, one of the largest hospitals in Turkey was opened, which ranked third in Europe and is considered a great leap in the world of medicine and health in Turkey.

Take a look at the future of real estate in Turkey:

Among the motives that drive capital owners to own property in Turkey is its secured future and predictions that its prices will rise during the coming period by up to sixty percent.

Through the following paragraph, we will inform you of the most important reasons that will lead to the rise in real estate prices in Turkey.

– High population density, where the population of Turkey exceeded 84 million people.

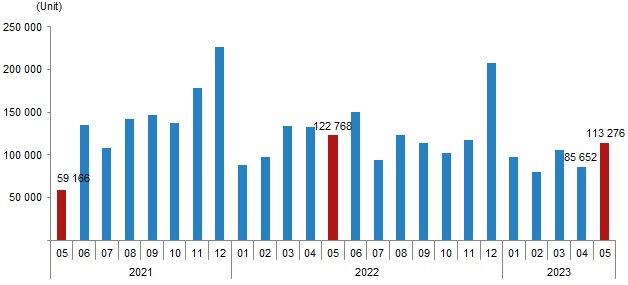

– The increasing demand for buying and owning real estate in Turkey.

– The huge tourist seasons that it witnesses lead to an increase in the demand for buying and renting them.

– The fluctuation of the value of the Turkish lira against foreign currencies.

– Rising costs of raw construction materials.

– The high quality of real estate in Turkey and the modern designs.

– Continuation of the Turkish citizenship program for 250 thousand US dollars.

Is now the best time to own real estate in Turkey? Will the Turkish government continue to provide facilities for foreigners wishing to own real estate in Turkey?

Turkey seeks to attract investors and foreign investments for the benefit and interest of the Turkish state, its economy and its real estate field. As a result of all these facilities, according to global indicators, the real estate market in Turkey is one of the most active real estate markets in the world and has ranked second.

And if you are wondering about the importance of the current period for buying real estate in Turkey, it certainly is. With the rise in real estate prices, you will get abundant profits when selling it in the future. Naturally, real estate markets do not remain the same for a long time and quickly fluctuate and prices change, especially if we are talking about a country that is witnessing great development in all its sectors and fields, such as Turkey.

We have provided you with important information about tax exemption in Turkey. We hope that you have obtained the benefit and full knowledge about this aspect, and we also shed light on the reasons that motivate any foreigner to choose Turkey to buy real estate.

Everything you want to know about the real estate sector in Turkey, we are keen to provide you with it to keep you informed of everything related to this field.

Related articles :

The Cheapest apartments in Turkey 2022

Conditions for obtaining Turkish citizenship

Cheap villas for sale in Istanbul Turkey

Obtaining Turkish citizenship by investment

The most important real estate companies in Istanbul

Benefits of buying a property in Turkey 2022

Real estate prices in Turkey 2022

How to obtain Turkish passport by investment